Aramid Paper (Aromatic Polyamide Fiber Paper) – High-Performance Specialty Material

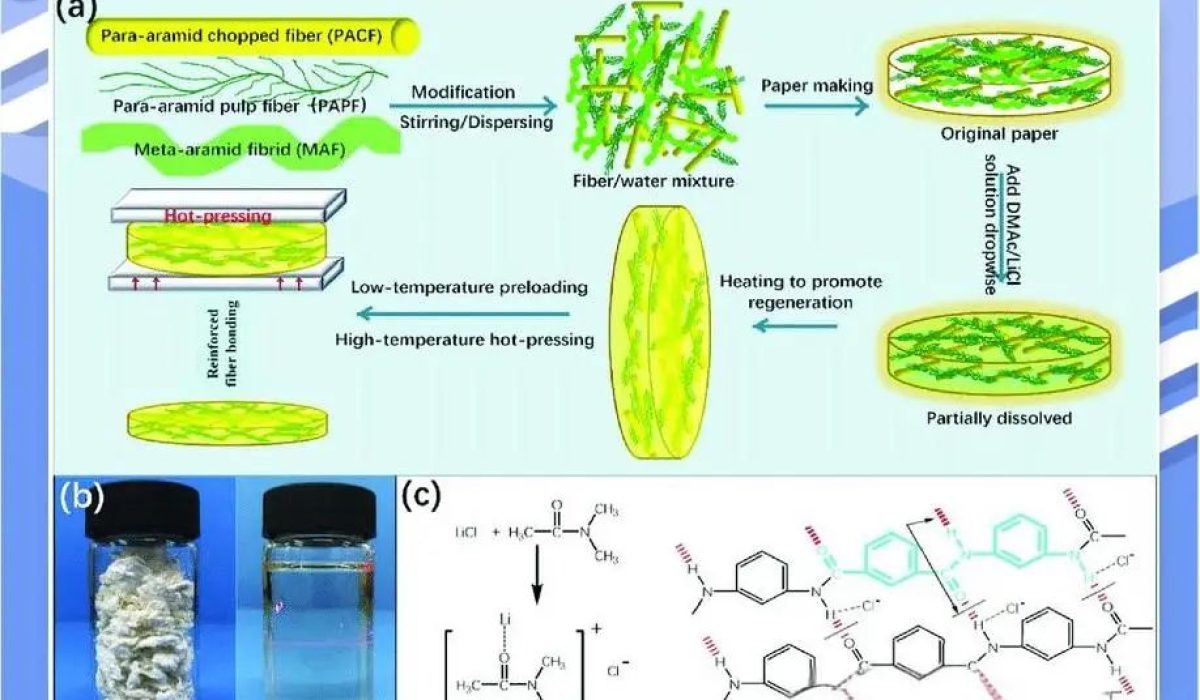

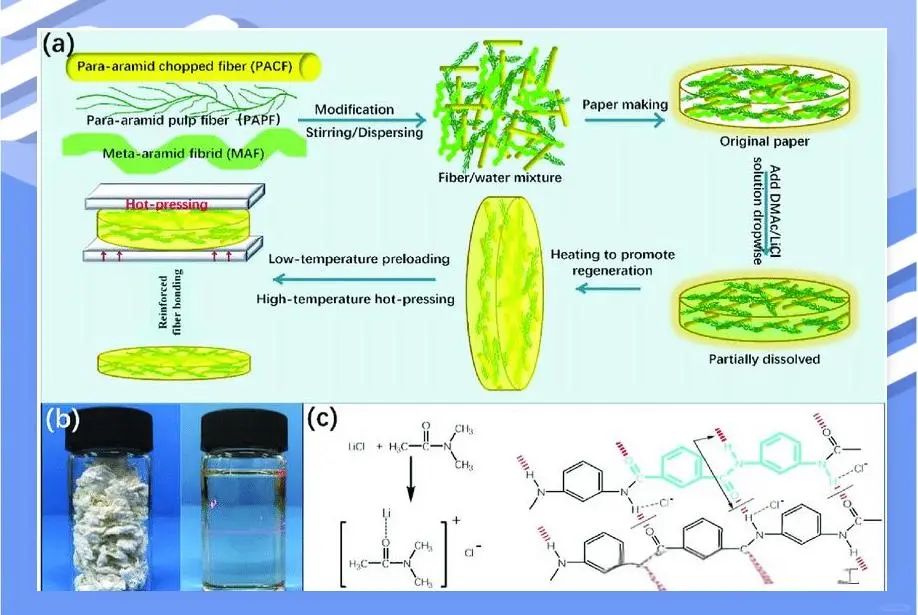

Aramid paper, also referred to as aromatic polyamide fiber paper, is an advanced engineered material manufactured through a precise wet-laid process combining aramid staple fibers with aramid fibrids. This specialized paper product features:

- Reinforcing Network: Uniformly distributed aramid staple fibers form a structural skeleton, providing exceptional mechanical strength

- Thermobonding Matrix: Aramid fibrids (including precipitated fibrids and fibrillated fibrids) soften during hot-pressing, creating strong inter-fiber bonds

- Superior Performance: The unique composition delivers outstanding tensile strength and excellent electrical insulation properties

Key applications include electrical insulation, aerospace components, and high-temperature filtration systems where thermal stability and durability are critical.

1. Global Aramid Paper Market Overview

Aramid fiber paper, a high-performance material made from para-aramid (e.g., DuPont’s Kevlar®) or meta-aramid (e.g., Teijin’s Nomex®), is widely used in electrical insulation, aerospace, automotive, and defense due to its heat resistance, lightweight, and durability.

Key Market Drivers:

- Demand from EVs & Electronics: Growth in electric vehicles (EVs) and 5G infrastructure fuels need for heat-resistant insulation.

- Aerospace Expansion: Lightweight materials for aircraft interiors and components.

- Replacement of Traditional Materials: Substituting asbestos and fiberglass in hazardous environments.

Major Global Players:

- DuPont (US) – Dominates with Kevlar® and Nomex®-based papers.

- Teijin (Japan) – Leading in meta-aramid papers.

- Yantai Tayho (China) – Emerging as a key competitor.

2. China’s Aramid Paper Market: Rapid Growth (2020–2024)

China has become a fast-growing hub for aramid paper production and consumption, driven by domestic industrialization and tech advancements.

Key Developments:

✅ Local Production Surge:

- Companies like Yantai Tayho Advanced Materials and SRO Aramid (China) have scaled up meta- and para-aramid paper output.

- 2023 Data: China’s aramid paper capacity grew by ~15% YoY, reducing reliance on imports.

✅ Government Support:

- “Made in China 2025” policy promotes high-performance materials, including aramid, for EVs and renewables.

✅ EV & Electronics Boom:

- BYD, CATL, and Huawei drive demand for battery separators and PCB insulation.

- 2024 Trend: Chinese EV makers use 30% more aramid paper in battery packs vs. 2020.

✅ Export Potential:

- Chinese manufacturers now compete with DuPont/Teijin in Southeast Asia and Africa.

Challenges:

- High Production Costs: Aramid pulp (raw material) remains expensive.

- Quality Gap: Some local products still lag behind DuPont/Teijin in consistency.

3. Future Outlook (2025–2030)

- Global CAGR: ~6.5% (Grand View Research).

- China’s Role: Expected to capture >25% of global market share by 2030.

- Innovation Focus: Thin-film aramid papers for flexible electronics.