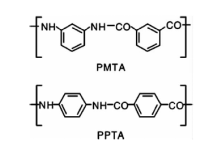

Aramid fiber, short for aromatic polyamide, refers to a class of synthetic polyamide materials where at least 85% of the amide bonds are directly attached to aromatic rings or their derivatives. Alongside carbon fiber and ultra-high molecular weight polyethylene fiber, aramid is recognized as one of the world’s three major high-performance fibers. Based on molecular structure, aramids are categorized into meta-aramid, para-aramid, and ortho-aramid. Among these, para-aramid stands out due to its exceptional properties, including high strength, high modulus, heat resistance, and anti-aging performance, making it widely applicable in bulletproof armor, automotive industries, electronics, optical fiber reinforcement, and more.

China’s aramid supply capacity has significantly improved, beginning to show a trend of structural surplus. Leading companies have achieved full industry chain layouts. In recent years, China’s para-aramid industry has developed rapidly. In 2024, China’s total para-aramid production capacity reached 31,000 tons/year, a year-on-year increase of 24%; output was 15,000 tons, with an apparent consumption of 18,000 tons and a self-sufficiency rate of about 83%. While some Chinese para-aramid products are now exported, high-performance variants still require imports, indicating an overall structural surplus in the industry. The top two enterprises account for approximately 72% of total capacity.

Production Capacity of Chinese Para-aramid Enterprises in 2024

| No. | Enterprise | Production Site | Capacity (tons/year) | Share |

|---|---|---|---|---|

| 1 | Tayho Advanced Materials | Yantai, Shandong | 5,000 | 50.2% |

| Ningdong, Ningxia | 10,500 | |||

| 2 | Sinochem | Yizheng, Jiangsu | 5,500 | 21.7% |

| Chengdu, Sichuan | 1,200 | |||

| 3 | SINOARA | Dongying, Shandong | 5,200 | 16.8% |

| 4 | Yizheng Chemical Fiber | Yizheng, Jiangsu | 1,000 | 3.2% |

| 5 | Jufang New Materials | Zibo, Shandong | 1,000 | 3.2% |

| 6 | Hebei Guigu Chemical | Handan, Hebei | 1,000 | 3.2% |

| 7 | Pingmei Shenma | Pingdingshan, Henan | 500 | 1.7% |

| Total | 30,900 | 100% |

In February 2024, Tayho Advanced Materials acquired Ningxia Xinguanghe New Materials to secure the supply of meta-phenylenediamine and para-phenylenediamine, thereby achieving a full industry chain layout from raw materials to end applications. China’s para-aramid capacity is expected to maintain strong expansion momentum. In January 2025, Sinochem International’s subsidiary, Sinochem Advanced Fiber, successfully started a 2,500-ton/year para-aramid expansion project, bringing its total capacity to 8,000 tons/year. In May 2025, Jiangsu Shengbang New Materials, a subsidiary of Shenghong Holding Group, successfully commenced production of a 5,000-ton/year para-aramid project, achieving integrated industrialization from “benzene – raw materials – spinning – products.” Additionally, Henan Shenma Aramid Technology’s 4,000-ton/year project is under construction. By 2030, China’s total para-aramid capacity is projected to reach 53,900 tons/year, with an average annual growth rate of 11.8% from 2024 to 2030. This will increase China’s global capacity share to 41%, significantly enhancing its worldwide supply capability.

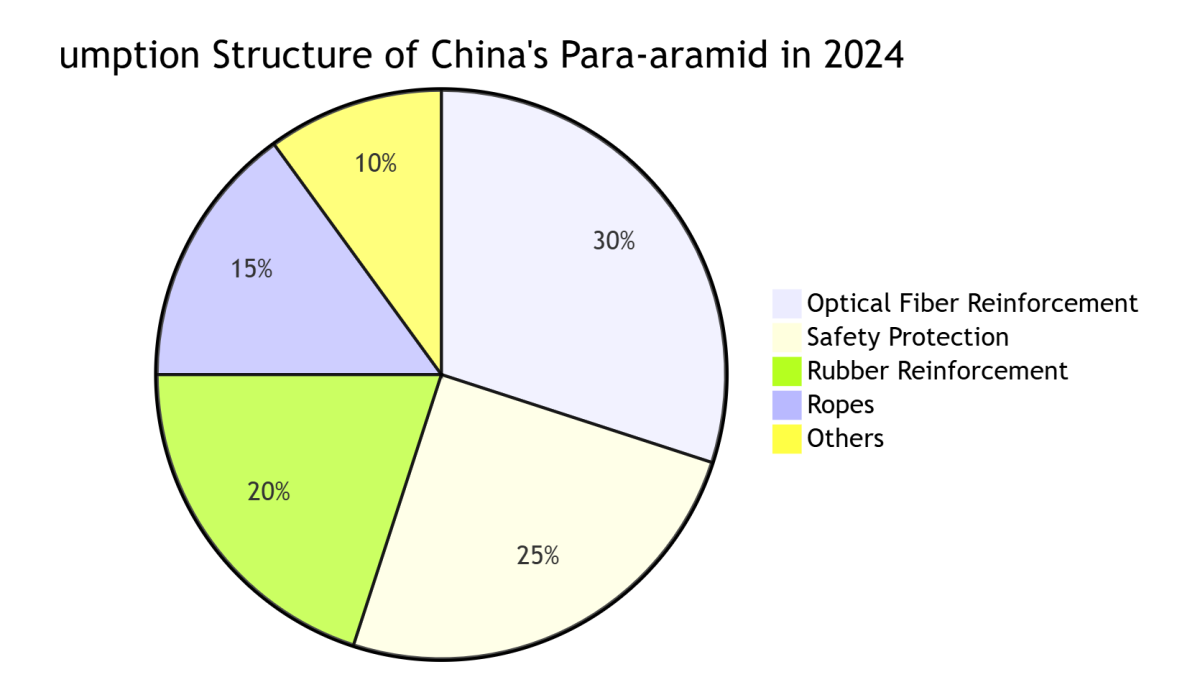

Fiber Optic Reinforcement and Safety Protection Are Major Consumption Drivers

In 2024, domestic apparent consumption of para-aramid was 18,000 tons, a year-on-year increase of 7.4%, primarily driven by fiber optic reinforcement and safety protection applications. Fiber optic reinforcement accounted for 40.4% of total consumption, making it the largest segment. In 2024, the total length of China’s optical cable lines reached 72.88 million kilometers, with 8.562 million kilometers added, representing a 13.3% year-on-year growth. However, as 5G network construction nears completion, the average annual consumption growth of para-aramid in optical cables is gradually slowing to between 4% and 5%.

In the safety protection sector, rising global tensions have significantly increased demand for protective equipment, driving a 14.2% year-on-year growth in para-aramid consumption in 2024, accounting for 24.9% of total consumption. Meanwhile, consumption in rubber reinforcement and rope applications grew slowly, at around 5% year-on-year. In the coming years, fiber optic reinforcement and safety protection are expected to remain the primary drivers of para-aramid consumption growth in China. As the economy recovers, consumption in rubber reinforcement, ropes, and other fields is also expected to rebound. By 2030, consumption is projected to reach approximately 25,000 tons, with a compound annual growth rate (CAGR) of about 5.7% from 2024 to 2030.

Increasing Capacity Intensifies Competition, Pressuring Industry Profits

In 2024, rapid capacity expansion in China’s para-aramid industry led to increased supply, while consumption growth lagged. International giants adopted low-price competition strategies leveraging economies of scale, and domestic companies engaged in price wars to capture market share, resulting in declining prices and significant profit pressure. In 2024, para-aramid for safety protection applications, which requires high performance, was priced between RMB 230,000 and 300,000 per ton; products for rope applications ranged from RMB 100,000 to 150,000 per ton; and those for rubber reinforcement, fiber optic reinforcement, and structural materials were priced between RMB 150,000 and 200,000 per ton. By 2025, para-aramid prices are expected to bottom out, with limited room for further decline.

Strategic Shifts Among Global Aramid Leaders

Teijin Plans to Shut Down Dutch Para-Aramid Plant

In January 2025, Teijin Aramid announced plans to close its aramid fiber production facility in Arnhem, the Netherlands, as part of necessary cost-cutting measures due to competitive pressure from Asia. Teijin’s exit creates a gap in the European para-aramid market, which Chinese companies are poised to fill with their cost-effective solutions and rapid response capabilities. Meanwhile, domestic firms are expanding into niche markets through differentiated strategies. This dual drive of technological catch-up and market substitution not only strengthens China’s autonomous and controllable industrial chain but also promotes the upward mobility of China’s para-aramid industry in the global value chain.

DuPont Plans to Sell Aramid Business

In July 2025, DuPont announced its intention to sell its Nomex (meta-aramid) and Kevlar (para-aramid) businesses as part of a major restructuring plan, aiming to complete the divestiture by mid-2025. Private equity firms Advent International and Platinum Equity are preparing bids, with an estimated transaction value of around RMB 14.4 billion. DuPont’s strategic adjustment opens up multiple opportunities for Chinese companies to accelerate their penetration into the global market, increase their global share of para-aramid, and expand into emerging applications such as automotive safety and new energy, enhancing product value-added.

In summary, China’s para-aramid industry is at a critical juncture of supply-demand restructuring and global realignment. Competitive pressures under structural surplus, upgrading consumption potential, and opportunities arising from international giants’ business changes will collectively drive the industry toward consolidation and breakthrough, advancing high-quality global development.